Build faster, smarter lending experiences

Deliver modern borrowing and account opening journeys that accelerate decisions, reduce friction, and increase conversion.

Lending and onboarding,unified in one experience

Candescent delivers Lending & Credit as a connected customer journey, not a collection of disconnected tools – bringing applications, decisioning, identity, fraud, and compliance together in a single, seamless experience.

Where lending becomes a growth engine

When lending and onboarding operate as a single experience, speed, transparency, and trust become built-in advantages.

Candescent helps institutions accelerate decisions, reduce abandonment, and increase completed applications so lending drives real business growth, not operational drag.

Candescent’s Marketplace extends the Lending & Credit experience with purpose-built partners for cloud lending, identity verification, fraud prevention, and compliance so institutions can evolve their lending strategy without disrupting operations or slowing down borrowers.

This enables institutions to:

- Move borrowers from application to decision faster

- Increase conversion by reducing friction and drop-off

- Shorten funding timelines and improve borrower satisfaction

- Reduce manual effort and operational costs

- Strengthen compliance without slowing down workflows

Lending intelligence is embedded directly into the borrowing journey – so decisions happen faster, workflows run smarter, and borrowers move forward with confidence.

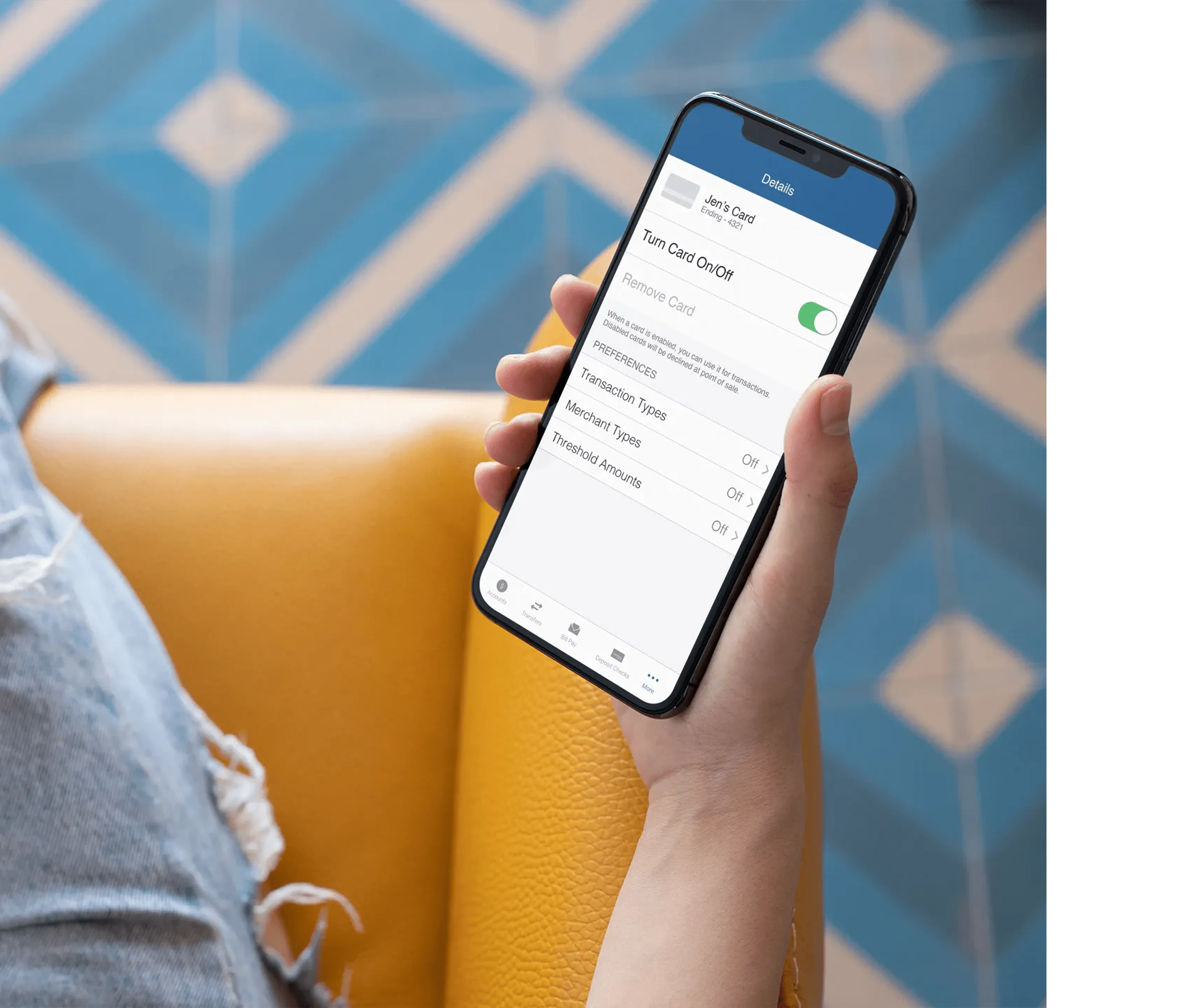

The experience

Borrowers can apply in minutes on any device, upload documents digitally, and track progress in real‑time—no branch visit required.

Staff benefit from consistent workflows, reduced rework, and clearer data.

For many loan types, closings can even be completed digitally.

The entire journey—from application to decision to fulfillment—becomes smoother, clearer, and dramatically faster.

Core outcomes

- Faster lending as automation speeds up decisions and reduces manual work

- Easier processes increase completed applications

- Built‑in checks reduce risk and errors resulting in stronger compliance

- Seamless digital applications lead to better experiences and boost satisfaction

Why this is different

- Application time reduced from nearly 1 hour to minutes

- Intelligent automation reduced manual reviews from >60% to <30%

- Faster, clearer decisions with connected data and unified workflows

- Higher staff efficiency and reduced fraud risk

Extend lending & credit through the marketplace

Activate pre-integrated partner solutions that expand Lending & Credit without adding complexity, operational burden, or disconnected experiences.

Explore Intelligent Banking solutions

Reimagine your account opening, digital banking and branch experiences with our integrated Intelligent Banking platform.

Account Opening

Digital Banking

Digital Branch

Consumer deposits

Real estate

Consumer loans and cards

Small business and commercial deposits

We're here to help

We can help you take the guesswork and complexity out of finding the right solutions.

.svg)

.svg)

.svg)